A Smarter Approach to Credit and Business Funding.

Since 2024, helping individuals and business owners improve credit and access capital with a thoughtful, proven process.

Better Credit Changes

What’s Possible

When your credit improves, options expand

More Control Over Borrowing Costs

Better credit can mean lower interest rates and better terms, helping you keep more money working for you.

Access to Financing When It Matters

Whether personal or business, stronger credit positions you for financing opportunities that align with your goals.

Confidence in Major Decisions

From housing to vehicles to business growth, improved credit gives you more flexibility when making important choices.

How can we help you?

Credit Repair

Personalized support to help improve your credit profile responsibly.

Review and analysis of your credit reports

Assistance with items such as collections, charge-offs, late payments, repossessions, bankruptcies, hard inquiries and more

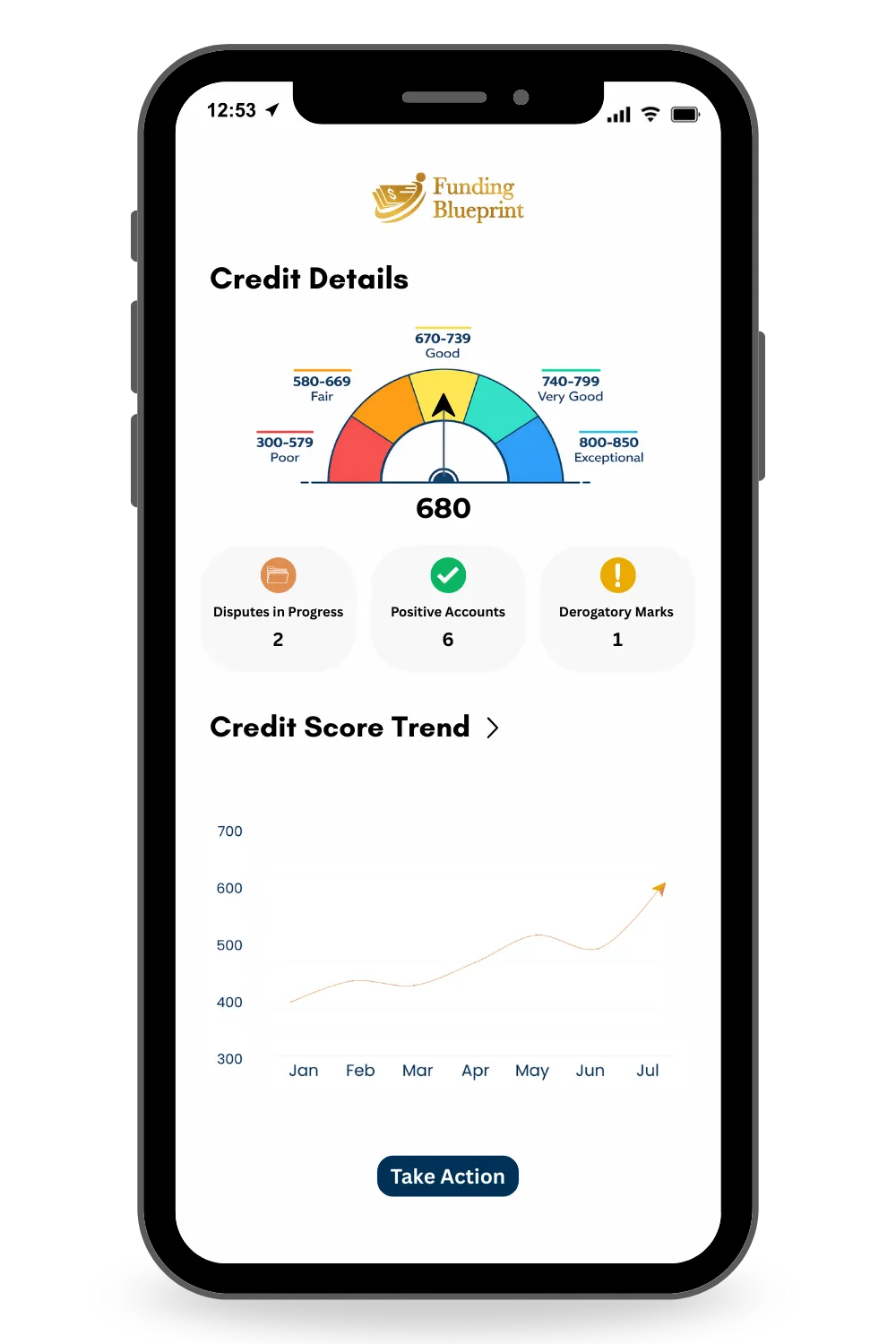

Ongoing guidance and progress tracking throughout the process

Business Funding

Helping you get properly positioned before applying for funding.

Preparation and optimization to position you to get funding

Guidance to unlock access to business credit cards, business lines of credit, SBA loans, term loans, and more

Support understanding lender expectations, timing, and next steps

Credit Education

Knowledge that helps you make smarter credit and funding decisions.

Learn how to obtain business funding for yourself and others

Learn how credit works, including credit basics, scores, and financing strategies

Practical education designed to support long-term success

Don't know where to start?

How does it work?

A clear process that helps you understand your credit and move forward with confidence.

Start with a credit review

We begin by reviewing your credit report and understanding your goals. This allows us to identify where you stand and what may be holding you back.

Personalized Analysis and Guidance

A specialist reviews your credit in detail, explains what we find, and outlines a clear, personalized path forward so you know exactly what to expect.

Strategic Action and Ongoing Support

When appropriate, we take action to address inaccurate or questionable items and keep you informed as progress is made, always focused on long-term improvement.

We are With you Every Step of The Way.

At Funding Blueprint, we're committed to your financial success and peace of mind.

That's why we offer a hassle-free money-back guarantee .

Frequently Asked Questions

How is your approach different from other credit repair companies?

Most credit repair companies use generic dispute templates. We identify actual

violations of federal consumer protection laws including the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), Truth in Lending Act (TILA), and Uniform Commercial Code (UCC). We reference specific case law in our strategies. If legal violations exist, we help you pursue your rights under federal consumer protection laws.

Do you work with Spanish-speaking clients?

Yes! We provide complete bilingual services in English and Spanish. All consultations, documentation, and educational materials are available in your preferred language. We understand the unique needs of Hispanic communities and provide culturally informed support throughout your credit journey.

What federal laws protect consumers in credit reporting?

Multiple federal statutes protect consumers:

* FCRA (Fair Credit Reporting Act) - Governs how credit bureaus collect and report data

* FDCPA (Fair Debt Collection Practices Act) - Regulates debt collector behavior

* TILA (Truth in Lending Act) - Requires clear disclosure of credit terms

* UCC (Uniform Commercial Code) - Governs commercial transactions

* ECOA, TCPA, RESPA - Additional consumer protections

When these laws are violated, you have legal rights including potential removal of

inaccurate information and monetary damages.

Can I really get compensation for credit bureau errors?

Yes, under federal law. If credit bureaus or data furnishers willfully violate FCRA

regulations, you may be entitled to monetary damages, plus attorney fees and court costs.

We identify when violations exist and guide you through the process—but we cannot

guarantee specific outcomes as each case depends on individual circumstances.

How long does the process take?

Credit restoration timelines vary significantly based on case complexity, the nature of

negative items, and how credit bureaus respond to disputes. Some items may be removed

in 30-45 days, while complex cases can take 6-12 months. We provide realistic timelines

during your consultation based on your specific situation. We cannot guarantee specific

timeframes as we don't control bureau investigation processes.

What credit monitoring platforms do you recommend?

We work with various credit monitoring platforms depending on your needs. During your

consultation, we'll recommend appropriate tools for tracking your progress. Some clients

benefit from comprehensive monitoring services, while others need basic bureau access.

Do you have a referral partner program for professionals?

Yes! We've built our entire practice around partnerships with loan officers, realtors,

mortgage brokers, tax professionals, accountants, and financial advisors. Partner with

us to unlock more opportunities for you and your clients. Contact us to learn about our

partnership approach.

Which services do you offer?

We offer three core services:

* Legal Credit Restoration - Federal law-based dispute strategies

* Business Funding Solutions - From LLC formation to capital access

* Credit Education & Training - Building lasting financial literacy

All services are available in English and Spanish.

How much do your services cost?

Pricing varies based on case complexity and services needed. We offer flat-rate pricing

for credit restoration (no monthly subscriptions) and customized quotes for business

funding services. During your free consultation, we'll provide transparent pricing

specific to your situation with no hidden fees.

What makes Funding Blueprint different?

1. Legal Approach - We identify actual federal law violations, not just "inaccuracies"

2. Partnership Model - We're built to serve referral partners and get clients back to them

3. Veteran-Owned - Military discipline, integrity, and commitment to service in every

client relationship

Ready to transform

your credit?

Get your free credit analysis today. We'll identify potential

violations and show you exactly how federal consumer protection

laws can work for you.

Where you're not a number. You're a priority.

Where you're not a number. You're a priority.

Your credit, your business, your financial future built on a solid legal foundation.

Quick Links

Services

© 2024-26 Funding Blueprint | All Rights Reserved